The October 2015 edition of the Food Demand Survey (FooDS) is now out.

There were sizable declines in willingness-to-pay (WTP) for all food products; meat and non-meat alike. At this point, it's unclear what is driving the decline because other measures on the survey, such as food expenditures both at home and away from home remained steady and slightly increased. In the coming months, I hope to find time to do some serious analysis on effects of seasonality and day-of-week effects given that we now have about two and a half years of data.

Another notable result from the survey is a decline in price expectations for beef, pork, and poultry. In some cases, the percentage of people anticipating higher prices is less than half of what it was a year ago at this time.

Consumers reported hearing more about antibiotics and less about Salmonella in the news this month.

Several new ad hoc questions were added to the survey this month. One set of questions related to food waste. These will be reported separately at a later date.

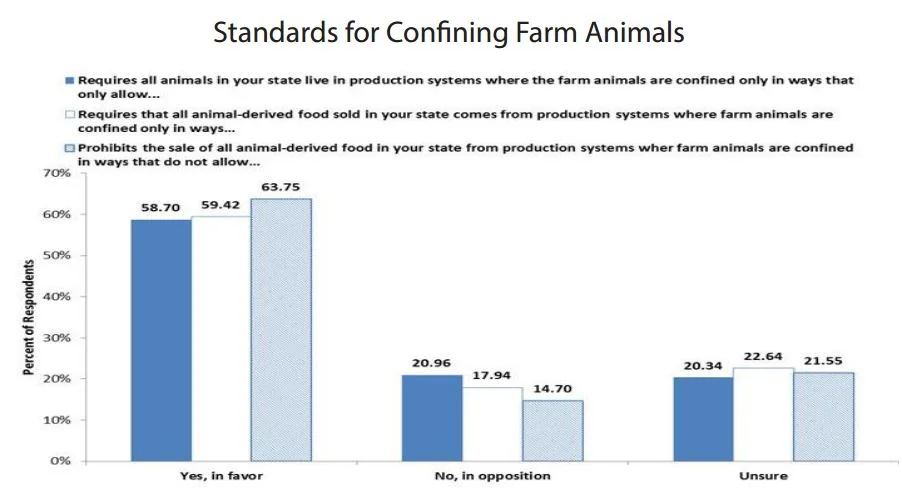

Another set of questions dealt with consumers’ opinion on policies related to farm animal confinement, similar to Proposition 2 that passed in California in 2008. Of particular interest was whether the framing of the issue affected voting outcomes.

Respondents were randomly allocated to one of three conditions. One third of participants in the first condition were asked to vote on an initiative that: “requires that all animals in your state live in production systems where the farm animals are confined only in ways that allow

these animals to lie down, stand up, fully extend their limbs and turn around freely.”

Respondents in the second condition were asked a similar worded question except it was framed as a ban on the sale rather than production. The initiative: “requires that all animal-derived food sold in your state comes from production systems where farm animals are confined only in ways that allow”.

Respondents in the third condition were asked the same question as in the second condition but “requires” was replaced with “prohibits”. The initiative: “prohibits the sale of all animal-derived food in your state from production systems where farm animals are confined in ways that do not allow”.

Participants were asked to respond “Yes, in favor”, “No, in opposition”, or “Unsure”.

Overall, the majority of respondents stated they would vote “Yes, in favor” in each of the three conditions. Despite the very different implications of the first and second initiatives, voting outcomes were nearly identical in the two conditions. In fact, framing had very little effect, aside from a “prohibition” eliciting more yes votes than a “requirement”.