That’s the title of a new publication from the National Academies of Science, Engineering, and Medicine summarizing the outcomes from a workshop on alternative proteins. I served on the planning committee and gave a talk about the market prospects for alternative proteins.

The report (pages 23-30) summarizes my talk. Here are a couple excerpts from my portion:

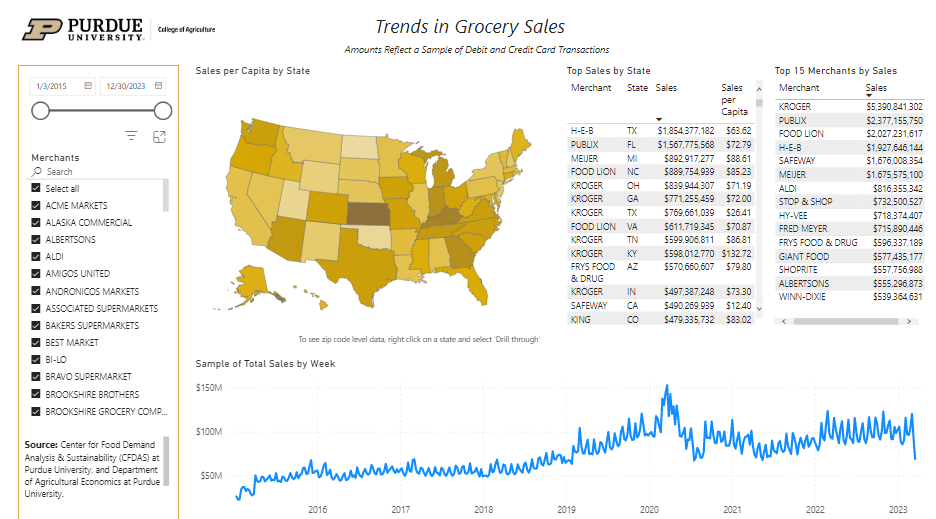

“Jayson Lusk, Purdue University, explored the socioeconomic impacts of increasing the intake of alternative proteins. He began with an overview of the economics of protein production in the United States, including agricultural land use, the current agricultural economy, farmers’ attitudes toward various protein sources, consumer purchasing habits and preferences, and market trends for alternative proteins. He explained that most dietary protein consumed in the United States is derived from animal sources, with poultry and meat as the top sources, followed by bread products, milk, cheese, eggs, plant-based protein foods, and seafood (Pasiakos et al., 2015). When the data are aggregated by animal, dairy, or plant-based sources, more than 80 percent of U.S. protein consumption comes from animal and dairy foods (Phillips et al., 2015). Lusk noted that protein quality varies, and statistics based solely on grams of protein consumed do not account for quality. ”

and

“Sales of plant-based meat alternatives constitute some level of substitution for animal proteins, as well as an expansion of the protein market, Lusk explained. Using an economic model that links retail consumption to cattle production, he examined how a shift in demand toward plant-based

meat alternatives—namely those created by processing a combination of ingredients such as soy, wheat, and pea, with novel additive ingredients such as heme (as opposed to less processed products such as tofu and tempeh)—could affect meat production (Lusk et al., 2022). Currently, he reported, these effects are fairly small. As an example, he observed that a 10 percent decrease in the price of plant-based meat alternatives is projected to create only a 0.15 percent decline in the number of cattle raised in the United States. As contributing factors he pointed to the small size of existing estimates across price elasticities of demand and the relatively inelastic nature of the U.S. cattle supply, which does not directly compete for land use with other forms of agriculture. ”

There is a lot more in the report, which summarizes a wide range of perspectives on alternative proteins.