The results of our October 2022 Consumer Food Insights survey are now out.

With Thanksgiving right around the corner, we asked consumers about their plans for the holiday relative to last year. 81% of consumers either somewhat or strongly agreed that the price of turkey would be higher this year compared to last. It appears more people than not are expecting smaller gatherings and less travel this year, which perhaps explains (along with the higher price expectations) the result that fewer people than not are expecting to buy a larger turkey this year.

In terms of our overall tracking statistics, we found that food away from home (FAFH) spending declined for third month in a row. However, food at home (FAH) spending remains high and similar to that observed in the the past five months. Perhaps surprisingly, given the high rates of food price inflation, our measure of national food insecurity is at its lowest point of 2022 so far.

Speaking of inflation, my colleague Sam Polzin who manages the survey and data analysis, noted a remarkable correlation between consumers’ inflation expectations measured in our survey and gas prices, as shown in the figure below.

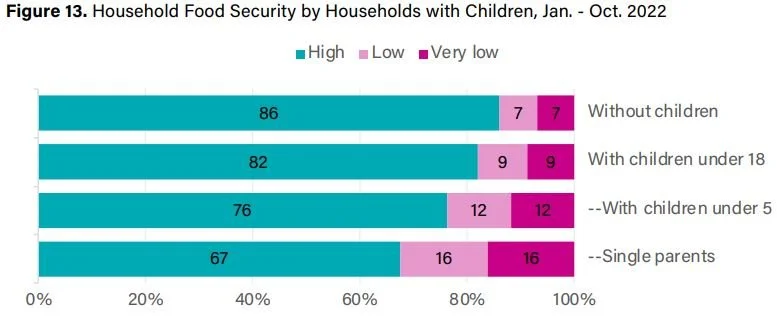

This month, we explored differences in our survey measures between household with and without children. Some of the largest differences were observed for food insecurity. Households with young children and single parents face highest rates of food insecurity.

Finally, we added some questions to compare with a recent Apollo Academic Survey conducted in collaboration with William Masters at Tufts University. That survey asked leaders, fellows, and awardees of the American Society of Nutrition and the Agricultural and Applied Economics Association (i.e., the experts) about their views on nutrition and policy. The survey of experts was motivated, in part, by an article in the Washington Post by Tamar Haspel in which she interviewed Will and me about our views on how to reduce the environmental costs of food production and consumption.

We thought it would be interesting to compare views of experts to those of the general public. The following two figures shows what the general public thinks about several health and nutrition issues. Will, Sam, and I are planning to write a separate piece doing a deep dive into the differences between experts and the public on these matters.

There is a lot more in the full report, which is available here.