Continuing my discussion from the paper I recently published with the Mercatus Center, I'll share a few thoughts about the academic research on USDA programs. This is a huge area of research and there is no way I can cover it all, but I'll try to touch the high points. Underlying citations for all these comments are in the paper.

Farm Payments

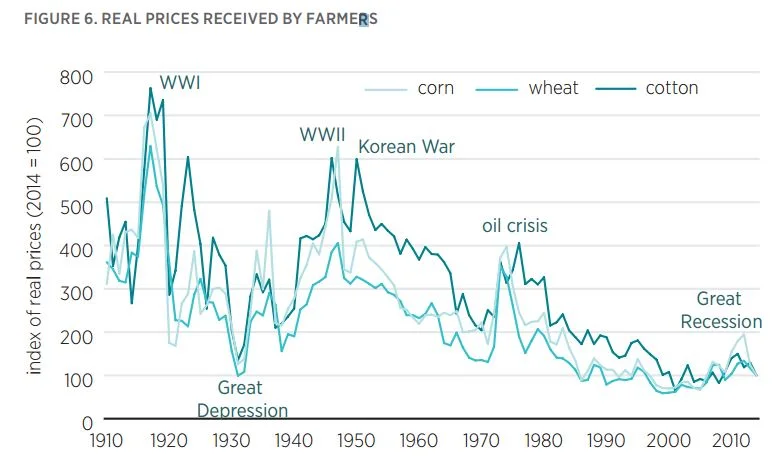

Standard economic theory suggests that subsidies, whether subsidies in the form of price supports on crops or subsidies on the premiums for crop insurance, distort production decisions and result in so-called deadweight loss. Subsidies—even supposedly “decoupled” farm payments that aren’t tied to production— can sometimes encourage greater production.

Moreover, economic theory suggests that farmers are not the ultimate beneficiaries of farm subsidies. That seems a bit counter-intuitive. How can the recipient of a subsidy not benefit from the subsidy? Well, given an additional subsidy, farmers will compete with one another and bid up the price of fixed assets, such as land or high-quality seed, implying that the owners of fixed assets, such as landowners or holders of patents on seed technology, capture a portion of the subsidy. There is substantial debate in the academic literature (here is the most recent paper on the topic) regarding the share of farm subsidies captured by nonfarmers, but economists almost universally agree that for every $1 in farm subsidies, farmers benefit by less than $1.

Despite popular claims to the contrary, research suggests that farm subsidies have likely had little to no effect on obesity rates.48 First, although such policies may have had some effect on farm commodity prices, these inputs account for only a small share of the overall retail cost of food. Second, agricultural policies are mixed, and some policies (such as those for sugar, ethanol promotion, and the Conservation Reserve Program, or CRP) push the prices of agricultural commodities up rather than down. Third, despite the widely varying agricultural policies across countries and over time (see the previous post), those policies do not correlate well with differences in food prices and obesity rates across countries or with changes in obesity rates over time.

Research suggests that the Conservation Reserve Program (CRP) program has achieved some goals related to erosion, wildlife, and soil and water quality, but some unintended consequences have occurred. Taking some cropland out of production can drive up commodity prices, which in turn incentivizes producers to plant more farmland. This is called a “slippage effect.” There is also some evidence that CRP payments contribute to higher land prices and thus benefit land owners.

Finally, agricultural policies create distributional effects across producers, locations, and commodities. That is, farm subsidies benefit some farmers more than others and actually harm other farmers and consumers.

Food Assistance Programs

While the original food stamp program had dual goals of farm support (or reducing government surpluses) and reducing food insecurity. However, little evidence verifies that the modern-day incarnation, SNAP, has any substantive effect on farm prices. For example, I calculate that for every $1 taxpayers spend on SNAP, farmers benefit by only a penny. Likewise, several years ago Martinez and Dixit calculate that food assistance programs increase farm prices by less than 1 percent.

Since at least the work of the economist Herman Southworth in the 1940s, debate has continued about whether food stamps (now SNAP) have effects that differ from unconditional cash transfers. Southworth noted that people who spend more on food than they receive in food stamp benefits (the so-called inframarginal consumers, who represent the vast majority of SNAP recipients) should, in theory, treat the benefits the same as an unrestricted cash transfer. The consumer can get around the restriction that SNAP payments be spent only on food by rearranging which items are purchased with SNAP benefits and which are bought with cash. Despite this theoretical result, some empirical evidence indicates that SNAP benefits tend to increase food purchases by a slightly greater amount than would be expected by an equivalent rise in income, though the evidence is debated.

For similar reasons as discussed above, more recent calls to restrict SNAP purchases to only healthy foods or to outlaw purchases of soda or junk food with SNAP benefits are unlikely to be successful; inframarginal consumers can reallocate which items are paid for by SNAP benefits and achieve the same consumption bundle at the same cost, irrespective of the soda or junk food restrictions.

Reasonably good evidence shows that food assistance programs accomplish their primary objective—reducing hunger among low-income Americans. In addition, the best academic research does not support the view that SNAP benefits result in higher rates of obesity (SNAP participation is correlated with obesity, but it probably doesn't cause it).

Agricultural Research

A large body of research has investigated the returns to agricultural research funding disseminating from USDA programs like National Institute of Food and Agriculture. The research tends to show large, positive benefits from public investments in agricultural research. One review of 35 studies finds that the average estimated rate of return on US public agricultural research is 53 percent, which is quite high compared with other investment alternatives. In fact, one paper by Julian Alston suggests spending on agricultural research is more beneficial to farmers than farm subsidies. Despite this, the rate of growth in public spending on agricultural research has slowed over time (though private spending has increased for some crops), a phenomenon some researchers argue is partly to blame for declining rates of productivity growth.