The November 2015 edition of the Food Demand Survey (FooDS) is now out.

A few highlights from the tracking portion of the survey:

- After a dip last month, WTPs for all products are back up in November.

- There was a BIG increase in awareness of E. Coli in the news in the past two weeks, perhaps due to the discussion surrounding the Chipotle.

- Despite the increase in awareness of E. Coli in the news, there was not a big change in concern about the issue.

- Consumers expect higher meat prices and expect to consume less meat in the next two weeks as compared to October.

Three ad hoc questions were added in response to the news a couple weeks ago that the International Agency for Research on Cancer, IARC) for the World Health Organization classified red meat as probably carcinogenic.

First, were a few questions meant to determine the tradeoffs people make between the taste of food, how long they live, cost, and food safety.

This was done by posing the following scenario: “Imagine you could live anywhere in the world. Suppose there were eight different locations you could choose from that were similar in all respects except for the types of food available. For each of the following eight locations, please rank how desirable it would be to live there.”

Then, eight options were presented (in random order) that varied food cost (at 10% to 20% of after tax income), taste (either better or worse tasting than you're used to), chance of foodborne illness (either 1 or 3 foodborne illnesses per lifetime), and life expectancy (either 75 or 85 years old) of different hypothetical locations. There are 2^4=16 possible different locations, and I showed people 8 of these such that none of the characteristics were correlated with the others.

Statistical analysis indicates the following formula (all coefficients except the intercept are statistically significant at the 0.01 level) implied by respondents' rankings:

(9-ranking)=desirability of location=0.10-0.035*Cost+1.31*BetterTaste-0.52*#Sicknesses+0.066*Age.

So people dislike higher food costs and foodborne illnesses, and they like better tasting food and living to older ages. No surprise there. The interesting questions relate to the magnitudes.

The results reveal people would be willing to pay about 38% higher food prices for better vs. worst tasting food (1.31/.035) and would give up 20 years of life expectancy to live with better tasting food (1.31/0.066). An extra case of foodborne illness is equivalent to about 15% higher food prices in terms of satisfaction with a location (0.52/0.035).

Looking at how rankings can change by moving from the lowest to the highest level of each characteristic suggests taste is the most important issue followed by safety, then life expectancy, then cost. The results reinforce what we already know: some people will continue to eat bacon even if the IARC says it increases the risk of cancer because they like how it tastes.

The next set of questions focused more specifically on whether people thought different issues could cause cancer, and then how many cancers the issues caused. In short, I tried to separate out (as the IARC does) the certainty with which we know whether something causes cancer from the size of the effect: that is, how much does a substance increase your cancer risk (see my previous discussion on this).

More humorously, Ted Underwood put it this way on Twitter:

A stubborn love of bacon just taught more Americans the difference between p values and effect size than 100 stats courses could.

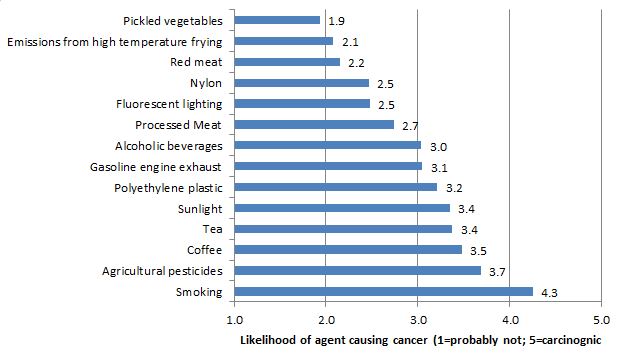

— Ted Underwood (@Ted_Underwood) October 27, 2015In any event, I asked “How much evidence do scientists have that each of the following items causes cancer?” Using the classification scheme used by the International Agency for Research on Cancer (IARC), respondents were asked whether they believed each item to be carcinogenic to humans (5), probably carcinogenic to humans (4), possibly carcinogenic to humans (3), carcinogenicity not classifiable (2), or probably not carcinogenic (1).

Most issues, including red and processed meat, were most rated as “possibly carcinogenic” (The FooDS report has the % in each category; here's a nice figure of how the IARC actually classifies different substances). Here how the different issues I asked about lined up in terms of respondents' perceptions.

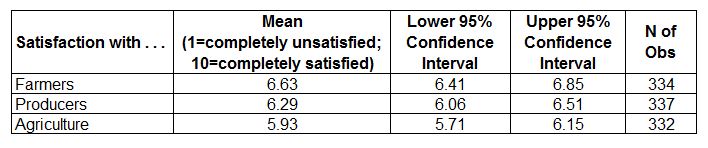

While the above was meant to measure certainty of evidence (i.e., the p-value), the last question was meant to measure effect size. Respondents told: “According to the American Cancer Society, there will be about 1.6 million new cancer cases in the United States this year. What percentage of those new cancer cases do you believe are caused by the following items?”

On average, respondents stated that approximately 30% of new cancer cases each year are due to smoking. Respondents stated that 14% of new cancer cases were due to other factors not listed. Processed meat was thought to be the cause of 6.5% of new cancer cases, while red meat was stated to be the cause of 5.8% of new cancer cases and tea ranked the lowest for causes of new cancer cases at 1.7%.

Despite the fact that the two questions are meant to measure different things, people probably conflate the two things in their minds (which is why this piece in the Atlantic said the IARC's classification is “confusogenic to humans.”). Here are the mean answers from the 1st question plotted against the mean answers to the 2nd question.

The correlation between the two is 0.62. Even removing smoking, the correlation is 0.33. That is, people tend to conflate the certainty of the evidence with the size of the effect.