Multiple sources today reported an item in the president's budget that would replace a portion of the Supplemental Food and Nutrition Assistance Program (SNAP, aka "food stamps") with physical food deliveries. Here is Politico:

“The proposal, buried in the White House’s fiscal 2019 budget, would replace about half of the money most families receive via the Supplemental Nutrition Assistance Program, also known as food stamps, with what the Department of Agriculture is calling “America’s Harvest Box.” That package would be made up of “100 percent U.S. grown and produced food” and would include items like shelf-stable milk, peanut butter, canned fruits and meats, and cereal.”

The proposal is being pitched as a government version of Blue Apron that will save taxpayers hundreds of millions of dollars. SNAP and consumer advocacy groups have expressed concern with the proposal; I haven't seen any overt advocates of the plan outside the administration.

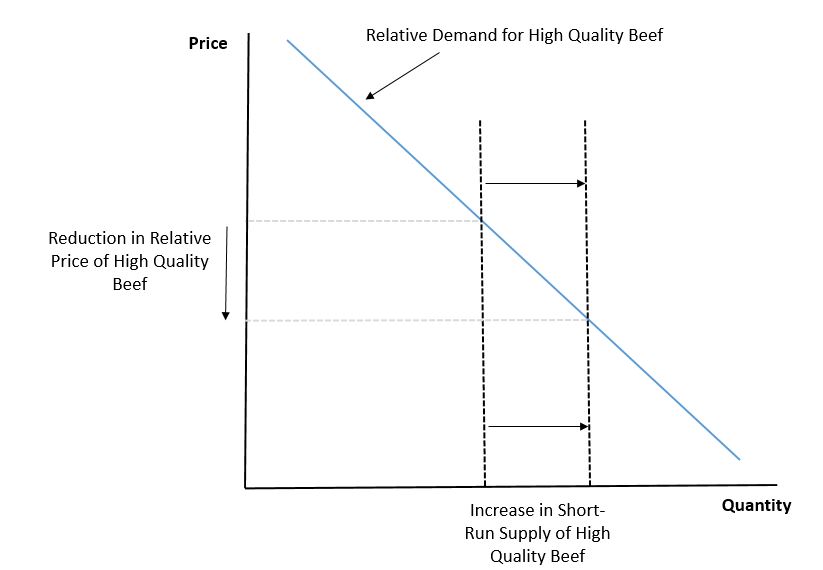

Economists have long favored unconditional (e.g., cash) to in-kind (e.g., food) transfers. The basic idea is that an individual consumer has a better idea of what they'll like than an administrator deciding which foods to put in a box. In other words, for the same budget, a consumer will be happier with cash than an equivalent dollar amount of food because the former provides more flexibility and freedom than the later. This value of flexibility could, of course, be offset if the administrator could acquire foods at a substantially reduced price compared to the average food consumer. But, this presumes the government administrators are more skilled in food acquisition than the Amazons, Walmarts, and Krogers of the world (or that these companies are taking in excess profits that could be passed directly to consumers).

There is another aspect to this issue that doesn't seem to be getting much attention. In particular, at least for some people, it doesn't matter if you give them food or SNAP. Here is Southworth writing in 1945 when earlier versions of SNAP were being debated:

“‘If a family would buy two pounds of beans anyway, giving it up to two pounds of beans as a consumption subsidy merely relieves it of the necessity of that much expenditure on its own behalf. In effect, its income is increased by the value of two pounds of beans, and it may spend some or none of this increased income on additional beans”

In short, if a household already plans to buy beans, it doesn’t matter whether the household is given beans or an equivalent amount of cash – the final outcome is the same.

But, what if the household wanted rice and not beans? Providing them beans means they are a little less happier than they would have been with an amount of cash (or SNAP benefits) equal to the beans that they then could use to buy rice.

Maybe the idea is that this version of the SNAP program would be more beneficial to U.S. farmers. But, these aid programs are hardly efficient forms of farm support. As I found in one analysis, for every $1 spent by taxpayers on SNAP, farmers benefit by only $0.01. If the idea is to support farmers, we'd be better off just sending them the dollar.

In the end, the purported benefits seem to hinge critically on the government's ability to deliver food at a price low enough that offsets the value of the loss of flexibility for the aid recipient.