Fortunately, it appears the worst of the COVID-related disruptions to meat and livestock markets may be over.

The figure below shows the most recent data on livestock and chicken slaughter (cattle and hogs are daily on weekdays; chickens is weekly). The worst of the disruptions occurred in late April and early May when we were running about 40% below last year, but significant improvements have been made since then. For beef and pork, the plants are mainly back online, but are running at reduced capacity due to social distancing of workers, etc. Beef and pork are currently running at about 10% to 15% below last year. Chicken processing hasn’t deviated more than plus or minus 10% from last year at any point during this period.

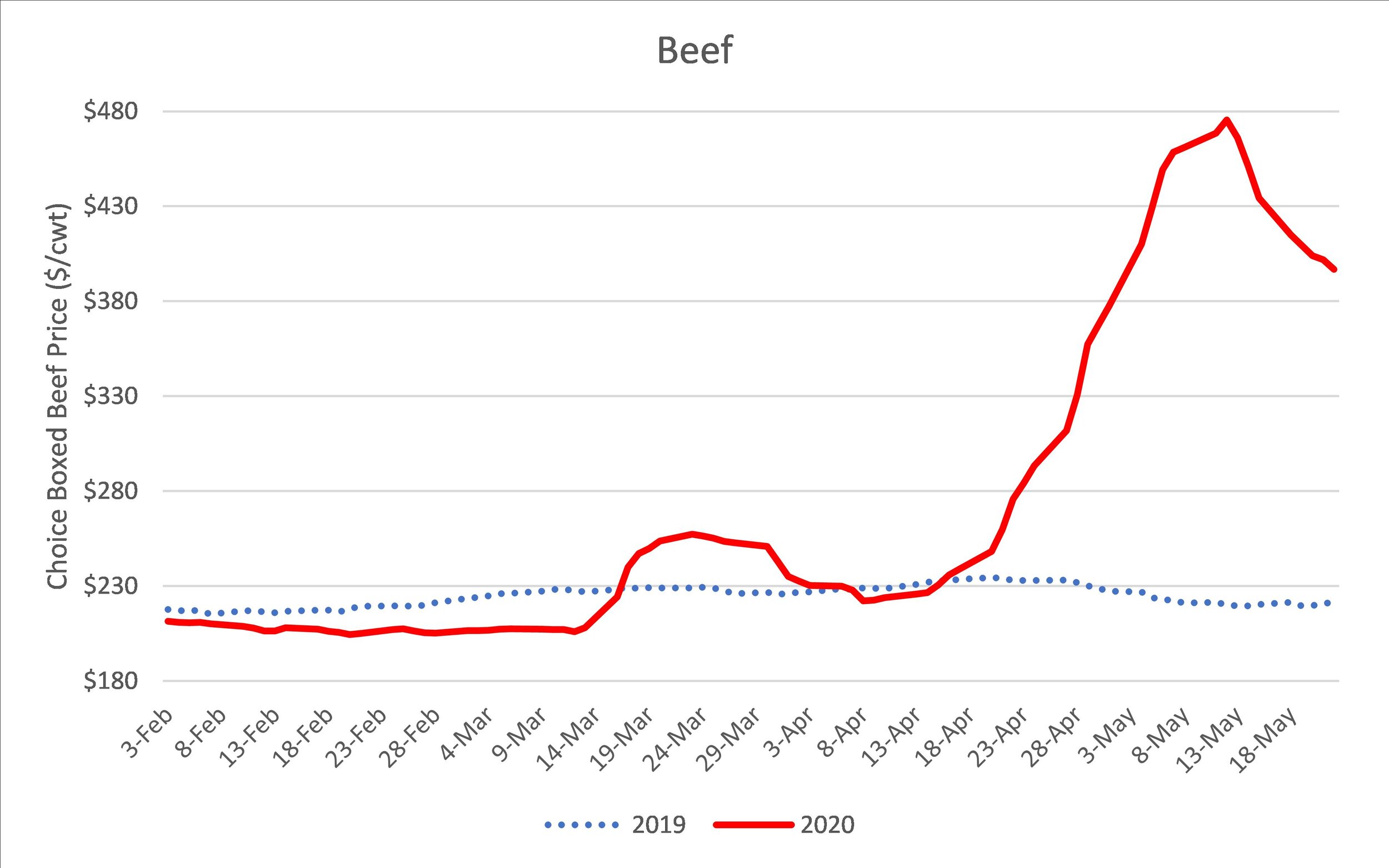

The changes in processing capacity have translated into changes in wholesale prices. Below are wholesale beef, pork, and chicken prices.

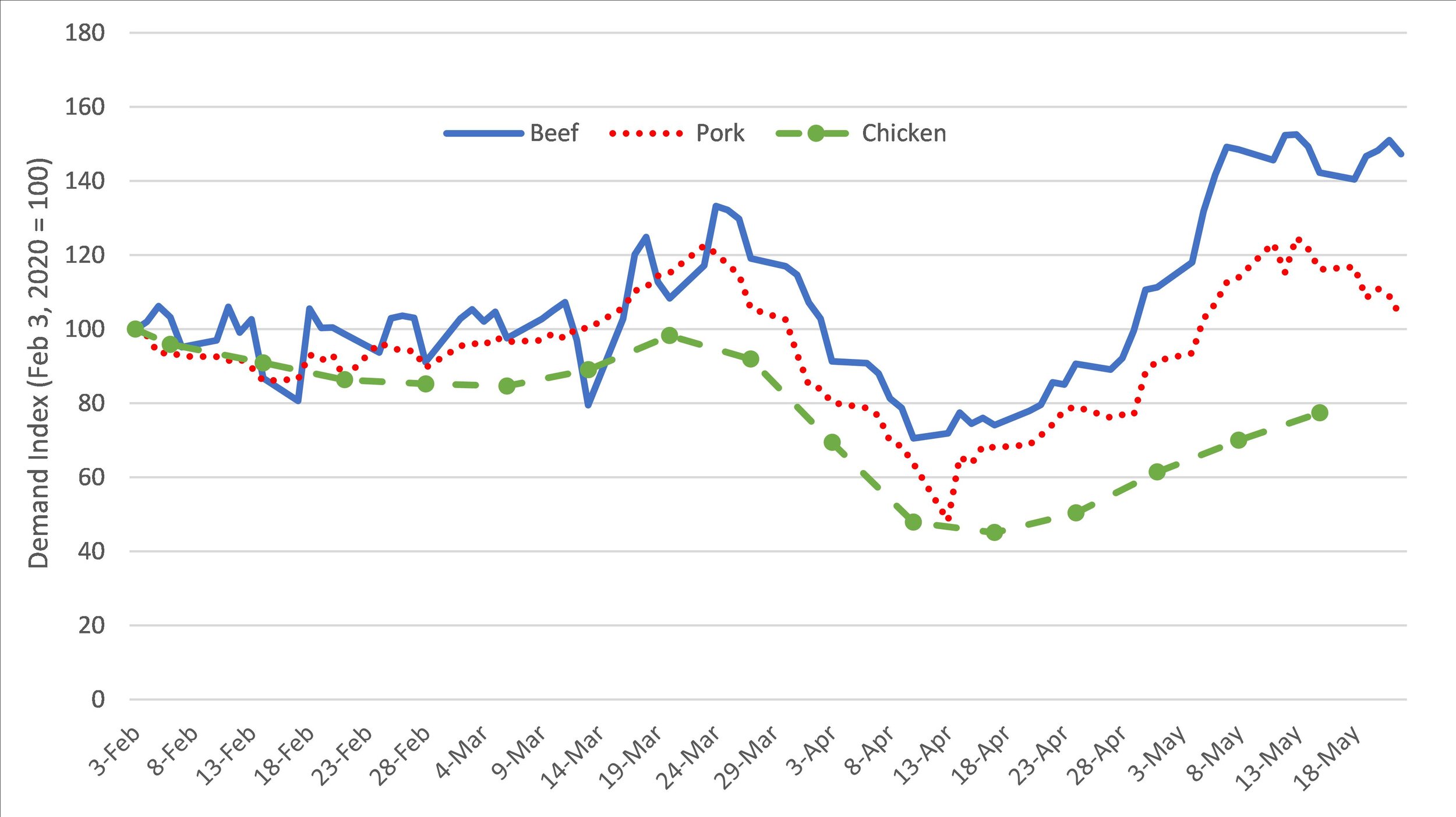

The quantity and price data above can be used to calculate demand indices, which are shown below.

Here are beef and pork marketing margins (the difference between wholesale meat price and the farm-level livestock price), which I previously discussed here. One of the reasons the pork margin is lower is that it is based on a carcass-weight hog price whereas the beef margin is based on cattle live weight prices.

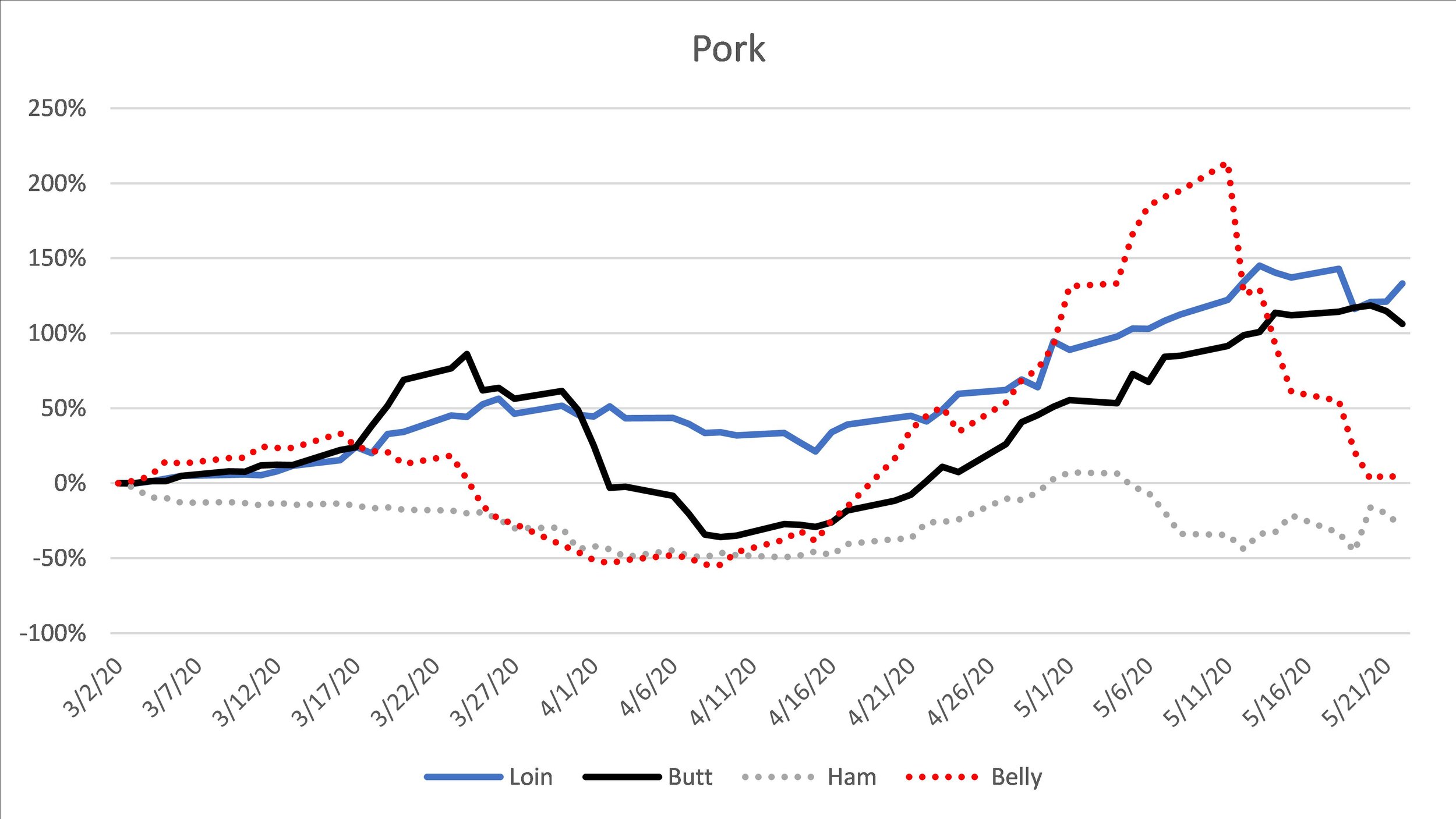

Finally, as I previously indicated, all meat isn’t created equal during a pandemic.