With the Center for Food Demand Analysis and Sustainability (CFDAS) at Purdue, we’ve been working on a project funded by the United Soybean Board and the Foundation for Food and Agricultural Research to explore the impacts of various investment alternatives on soy farmer profitability. To undertake the economic modeling, we need to understand consumer demand for a variety of soy-based foods, and the extent to which consumers are willing to substitute between soy-based foods and other products.

We’ve now released three short research reports on consumer demand for:

dairy, almond, oat, and soy-based “milks” (with Miyeon Son)

soy, corn, olive, and canola cooking oils (with Miyeon Son)

meat and meat-alternatives (by Glynn Tonsor and Justin Bina)

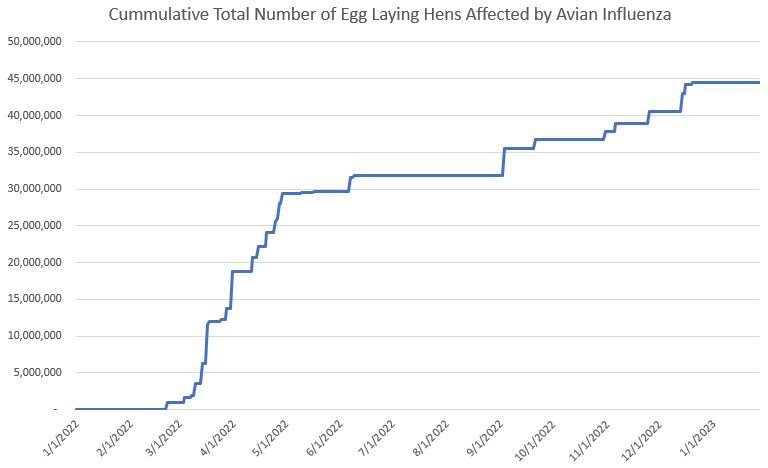

There is a lot of interesting material in each report. For example, here are a couple graphs showing trends in the milk and milk-alternative markets. The big story here is the rise of oat milk, which has cut into sales of other milk-alternatives.

Another interesting finding from the meat and meat-alternatives paper that is consistent with prior research is the low degree of substitutability between conventional meats and the new meat alternatives. In fact, the estimates suggest chicken is a weak complement with (rather than a substitute to) meat alternatives.