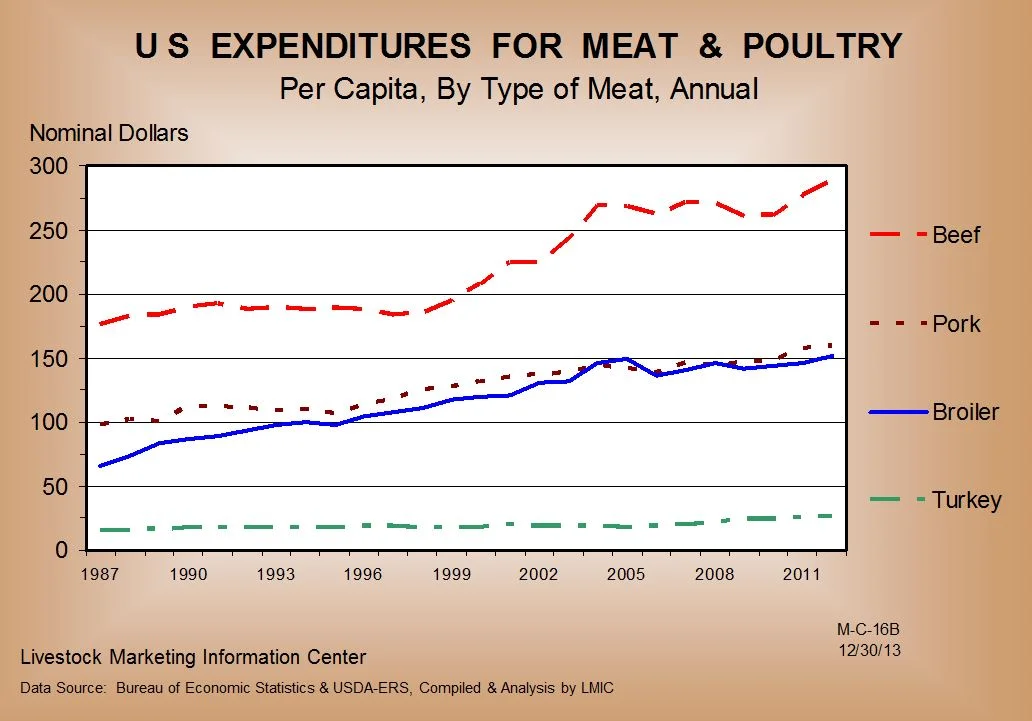

If you've been down the meat aisle in the grocery store recently, you might have noticed that beef is getting pricey. Indeed, cattle prices have recently been near historically high levels in recent months. For some perspective, here are inflation-adjusted retail meat prices since January 2000 (these are monthly USDA data compiled by the Livestock Marketing Information Center and the USDA-ERS; final data point is January, 2014).

As you can see, real beef and pork prices are higher now than they've been in at least 15 years (and that means they're substantially higher in nominal terms).

As the graph reveals, starting in about 2010, beef and pork prices began to rise, although the rate of increase has been faster for beef than for pork. Over the same time period, chicken prices have remained relatively constant, and are actually slightly lower in real terms today than in the early 2000s.

The graph above masks what has been happening in the last few weeks and months. On that issue, here is a graph from the Livestock Marketing Information Center showing wholesale boneless beef prices (fresh, 90% lean - mainly used in ground beef) in recent weeks. As you can see, 2013 prices were above the 2008-2012 average, and 2014 prices are much higher still.

What is happening that has caused the run-up in beef prices?

The answer to that question is a dissertation topic unto itself, but here are a few rough thoughts:

- I don't think the answer is primarily on the demand side. Despite all the negative publicity for meat products (from media coverage of food safety, animal welfare, global warming, health, water use, etc. etc.), estimates from our Food Demand Survey and from the demand indices compiled by Glynn Tonsor at Kansas State suggests relatively stable to slightly increasing demand. Higher demand will tend to pull up prices, but I don't think the demand changes are anywhere near large enough to explain the price rises.

- Increased demand for meat products from other countries might tell part of the story, and although there has been a general rise in beef exports in recent years, it also doesn't seem big enough to explain the trend.

- That leaves supply-side issues. Cattle inventories are at their lowest level since the 1950s. Because of technological advancement, we don't need as many cattle today today to produce the same amount of beef as we did in 60 years ago. Still, fewer cattle numbers means less beef, and less beef supplied means higher prices. Contraction in cattle supplies can be explained by a number of factors, such as drought in the plains states that limited the amount of grass and hay available and higher feed (mainly corn) prices due to drought, ethanol policy, etc., which pushed pushed more cattle to slaughter several years ago, leading to smaller inventories today. Feed prices have now come down off their highs but cattle prices are still rising, partially because producers are holding back breeding stock to rebuild inventory. Still, if high feed prices were THE answer, I would have expected chicken prices to rise in tandem with beef and pork (at least over part of the period), but as the above graph reveals, they didn't.

- It is also worth noting that on the supply side, the beef industry has stopped using technologies that previously generated more meat from each animal.

- The industry largely moved away from using lean fine textured beef (LFTB - aka "pink slime") in March 2012. It has been estimated that not using LFBT is akin to reducing the cattle supply by about 1 to 1.5 head million annually. So, removal of LFTB had an effect of further reducing supply on top of the other aforementioned factors. One study suggests that removal of LFTB increased ground beef prices by about 3.5%. Here is a recent TV news story about the role of LFTB and beef prices (I was happy to see they interviewed Kate Brooks from University of Nebraska - one of my former students).

- The industry also moved away from using the beta-agonist, Zillmax. According the the product's manufacturer, Zilmax added 24-33 lbs of additional hot carcass weight. Multiply that by millions of head of cattle, and that's millions of pounds of beef that are now "missing" relative to a year or two ago.

- On the pork side of the equation, there is a lot of concern about the porcine epidemic diarrhea virus (PED), which is kills young pigs. It is yet unclear what effects it may be having, but speculation suggests it might be tightening supplies and pushing up pork prices. This is a relatively recent phenomenon and can't explain the 2010-2011 increases.

Addendum:

Scott Irwin sent me a note with a couple links to posts at farmdocdaily, which touch on these same issues. First, he noted (in a post almost four years ago!) that the corn/soy prices then were likely to lead to much higher livestock prices. So what we are seeing now may be the fruition of this longer-term adjustment. Second, Chris Hurt posted on March 3 about PED, and it does appear to be a big deal - hog futures are at record levels. Chris concluded:

At the farm level, current futures markets are suggesting a live price for 2014 at a record high of $73 per hundredweight compared to $64 last year. This will provide record high industry revenues and the highest profit per head since 2005.

Who is going to pay for these record high pork producer revenues? Unfortunately, the consumers of pork are expected to be large net losers from PED-V as they will have to pay record high retail pork prices and also have less pork availability.