Of the 17% who said they had worked on a farm, 43% checked “A farm that produces commodity crops (e.g. corn, wheat, soybeans, cotton, or rice)” followed by 40% who checked “A farm that produces commercial livestock (e.g. cattle, swine, or poultry).” “A garden in your backyard” was picked by 38% and “A chicken coop in your backyard” was picked by 23%. 20% checked “other” (and provided responses such as working on a dairy farm or a horse farm or on school farms such as FFA), and 12% checked “A community garden”.

Secondly, participants were asked: "Which of the following animal production industries use added growth hormones?” Over half of participants stated that believed beef, pork, poultry and dairy industries use added growth hormones. Over 75% of participants indicated that they thought that the beef cattle industry uses added growth hormones. Over half of the respondents stated they believe the swine and poultry industries to uses added growth hormones. In reality, the swine and poultry industries do not use any added growth hormones. About 57% of participants stated they believed added growth hormones are used in the dairy industry.

Third, participants were asked: “What percentage of dairy cattle in the U.S. are treated with rBGH?” Overall participants perceive a much greater use of rBGH in dairy cattle than what is actually used. About 20% of participants believe that 50-59% of dairy cattle are treated with rBGH. 5.7% believe that 90- 100% of dairy cattle are treated with rBGH. Only, 10.9% of participants stated that less than 10% of dairy cattle are treated with rBGH. In reality, less than ten percent of all dairy cattle in the U.S. are treated with rBGH.

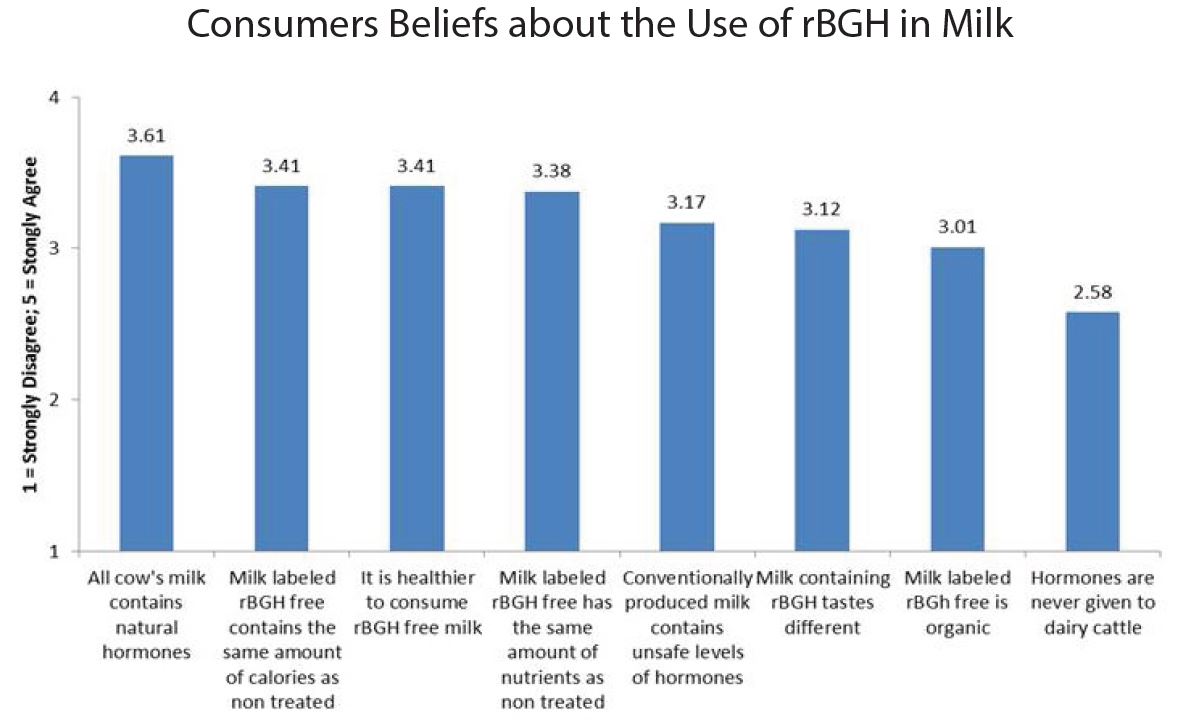

Lastly, participants were asked: “To what extent do you agree or disagree with the following statements?” Individuals responded on a 5-point scale: 1=strongly disagree, 2=somewhat disagree, 3=neither agree nor disagree, 4=somewhat agree, 5=strongly agree.