Yesterday, David Ludwig and Kenneth Rogoff, prominent pediatrician and economist respectively, published an article in the New York Times about obesity. The following is a passage from the piece.

“Farm policies have made low-nutritional commodities exceptionally cheap, providing the food industry with enormous incentive to market processed foods comprised mainly of refined grains and added sugars. In contrast, vegetables, whole fruits, legumes, nuts and high-quality proteins are much more expensive and, in “food deserts,” often unavailable. ”

The authors have already taken a bit of a beating about this on Twitter from the agriculturally-literate-intelligentsia. Why? Because these sentences give the incorrect impression that farm policy is a major contributor to obesity. That's not saying farm policies aren't inefficient, only that they do not have the effects many people claim they do.

Why would farmers support policies that would make commodities "exceptionally cheap" and thus lower their profits? Yes, there are some policies that likely increase production beyond what would happen in an un-distorted market, but there are other policies that reduce production. Take corn, for example, which is the largest agricultural crop in the U.S. in terms of value of production. The existence of subsided crop insurance subsidies and commodity programs might increase the tendency to produce more than would otherwise be the case, but ethanol policies from the EPA re-direct much of that production to fuel rather than food. Moreover, there are countervailing policies such as the Conservation Reserve Program (CRP), which remove land from production. In addition, sugar policies push the price of sugar up, not down.

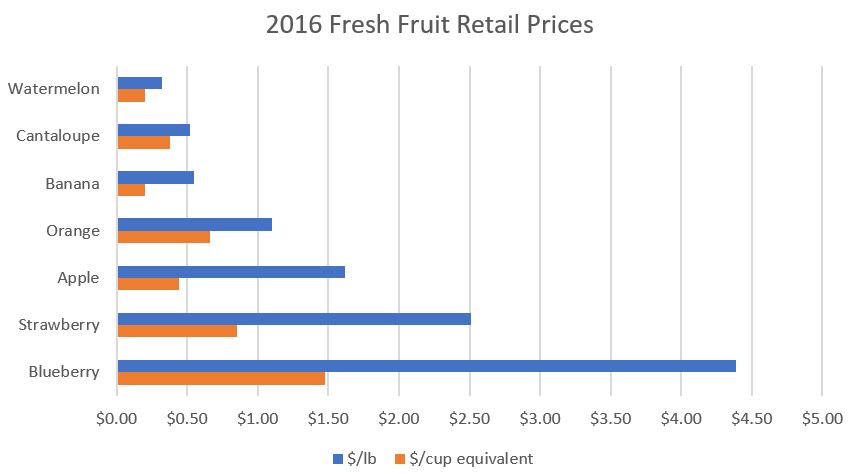

The authors also point to processed food as another big evil, but in so doing they (correctly) undercut the argument that farm policy is a major culprit. How so? Well, for every $1 we spend on food, only about $0.15 results because of the cost of the farm product. The other 85% of the cost is from transportation, processing, packaging, marketing, retailing, etc. As a result, changes in farm commodity prices have relatively small impacts on retail prices.

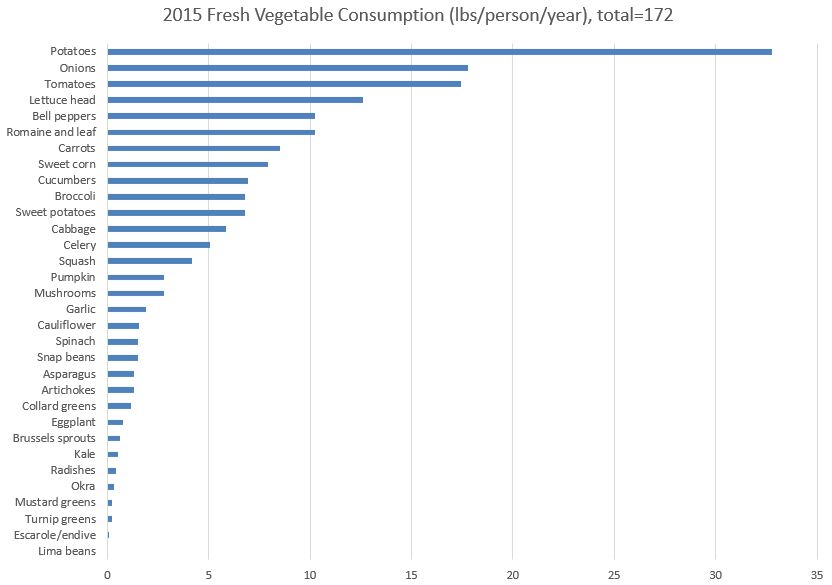

Fruits and vegetables are indeed more expensive than many commodity crops, but that's because of biology not policy (see more on that here and here). Here's what I wrote in one of those posts:

“why do we grow so much corn, soy, and wheat in the U.S.? A primary answer is that these plants are incredibly efficient at converting solar energy and soil nutrients into calories (they’re the best, really the best). Moreover, these calories are packaged in a form (seeds) that are highly storeable and easily transportable - allowing the calories to be relatively easily transported to different times and to different geographic locations. Contrast these crops with directly-human-edible fruits/vegetables like kale, broccoli, or tomatoes. These plants are poor converters of solar energy to plant-stored energy (i.e., they’re not very calorie dense), and they are not easily storeable or transportable without processing (mainly canning or freezing), which requires energy.”

If you don't believe me, there is a long literature by agricultural economists on this subject. See this book by Julian Alston and Abby Okrent or these papers in American Journal of Agricultural Economics or Journal of Health Economics, the later of which was co-authored with Brad Rickard. Other papers take entirely different approaches but arrive at the same conclusion. See this paper in Food Policy by Corey Miller and Keith Coble or this one by Alston, Sumner an Vosti, also in Food Policy.

As for the efficacy of the other policies proposed by Ludwig and Rogoff, I'm skeptical of their efficacy in truly affecting obesity. See this paper I recently published in Applied Economic Perspectives and Policy or my 2013 book, The Food Police.