The January 2023 edition of our Consumer Food Insights (CFI) survey is now out. This marks the 1 year anniversary of the inaugural edition of CFI, such that we can calculate year-over-year changes and now compare current estimates to the 2022 benchmark. Thanks to the members of the Center for Food Demand Analysis (CFDAS), particularly Sam Polzin, who have done a masterful job getting the survey out the door every month and expertly analyzing and reporting the results.

Given the new year, we asked respondents if they made any resolutions related to food and nutrition. About 1 in 5 said “yes.” All respondents were asked if they planned to make changes in their eating and exercising habits in the New Year. Here’s how people prioritized different activities.

Respondents said they planned to eat more fruits and vegetables, exercise more, and eat fewer snacks; they were least likely to say they would be eating less meat or growing their own food.

We ask a question every month about whether people were unable to find specific items when shopping. If someone says “yes” indicating a stock-out, which ask which items were missing. Below is the comparison from December to January. There was a dramatic increase in the number of people who said eggs were missing over this one month period over the same period egg prices spiked. Still, given that about 1,200 people take the survey, this implies only about (50/1200)*100 = 4.2% of respondents experienced an egg stock-out in January.

Our Sustainable Food Purchasing Index (SPI) remains fairly steady, but compared to last year, there is an improvement in taste, economic, security, and nutrition dimensions of sustainability. The environment indicator dipped a bit.

Consumers’ spending on food away from home (i.e., restaurants) has increased over the past three months and total food spending is up about 19% relative to the same time last year. There is an uptick in how much consumers say food prices have risen over the past 12 months, but they continue to expect lower rates of food price inflation for the future.

We find that our measured rate of food insecurity is essentially unchanged, although there is a dip in the share of households indicating that they have received free food from a food bank or food pantry this month.

This month we added some new questions on risk taking in different domains. On average people say they are not strongly risk averse (score of zero) or strongly risk loving (score of 10) - with an average score of 5.4. However, when asked the same question about their health, people are more conservative (average of 4.3). Median scores are also lower when asked about food consumption, suggesting people are less willing to take risk for health and food than for life in general.

With regard to stated food buying behaviors, we find a 9% reduction in the number of people who say they’re choosing plant-based proteins over animal proteins. This is consistent with the much discussed decline in sales of plant-based meat alternatives.

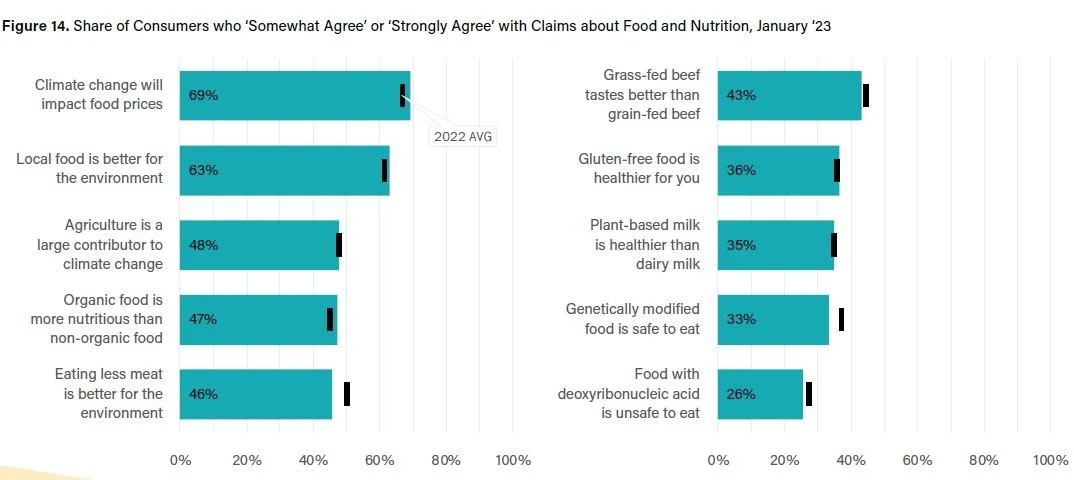

We observed some changes in consumers’ food and environmental beliefs. Fewer people today say GMOs are safe to eat or that eating meat is better for the environment than was the case last year.

Compared to last year, this month, we are seeing sizable increases in trust in food-related information from people’s personal physicians, the American Medial Association, and the Dietary Guidelines committee. Conversely, there were sizable declines in trust of food companies like Nestle, Tyson, and McDonald’s.

Finally, leading into the Farm Bill debate this year, I’ll leave this figure here indicating the degree of support/opposition for several food/ag policies (exact wording is in the full report).

The whole report is available here.