The declaration of a national emergency on March 13, 2020 by President Donald Trump, and the corresponding state stay-at-home measures, caused significant disruptions in retail food markets. Aside from take-out, many consumers were suddenly unable to dine at restaurants and food service establishments away from home, which according to U.S. Department of Agriculture data, represents about 54% of all food expenditures. As a result, consumers turned to grocery stores and supermarkets, where the increase in demand, coupled with concerns about future reduced mobility and scarcity, led to a surge in foot traffic and sales.

For the week ending March 22, 2020, the number of trips to grocery stores and supermarkets increased 39%, and during each trip, consumers purchased about 12% more items, and spent, in aggregate, about 61% more as compared to the same week one year prior. Fresh meat and frozen food sales led the increase in dollar sales. Pork sales increased 101%, beef sales increased 95%, and chicken sales increased 70% for the week ending March 22, 2020 as compared to the same time period in 2019.

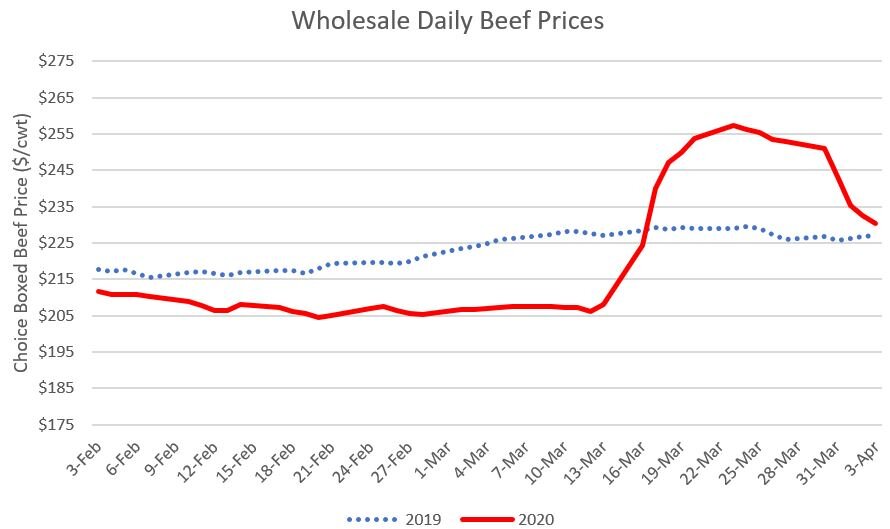

Increasing food prices suggest the increased demand in grocery establishments appears to have more than compensated for the lost demand at restaurants, at least in the short run. The figures below report U.S. Department of Agriculture data made available by the Livestock Marketing Information Center on wholesale prices of pork, beef, chicken, eggs. In each of these cases. wholesale prices began dramatically rising at about the time President Trump declared the national emergency. For example, wholesale pork prices jumped almost $20/cwt from about $65/cwt in early March to just under $85/cwt by mid-March. For beef, wholesale boxed beef prices increased about $50/cwt, going from about $205/cwt to over $255/cwt. Wholesale chicken prices increased a bit over $10/cwt over this same time period. However, as the figures reveal, the price pressure has already started to subside for beef, pork, and chicken. In fact, for pork and chicken, price levels are near or below what was experienced at the same time last year.

The case of eggs reveals a different story. Wholesale egg prices were about $1/dozen in early to mid-March 2020, approximately in line with prices at the same time in 2019; however, prices have nearly tripled since that time, and by the week ending April 4, 2020, prices were $3/dozen, with the increase showing no sign of slowing yet. A number of explanations have been offered for the price run-up in the egg market including consumer perceptions about the necessity of eggs and their longer shelf life relative to other animal proteins, dynamics associated with Easter egg buying, legal barriers that prohibited easy re-sale of eggs headed for restaurant markets to grocery, and the high degree of concentration in the egg production industry.

The increases in wholesale meat prices were not initially met with corresponding increases in farm-level hog and beef prices, causing consternation among some producers. Going forward, increased concerns about illness spread in packing houses is likely to reduce processing capacity, further exasperating this problem, putting downward pressure on livestock prices. A paper by Glynn Tonsor and Lee Schultz suggests a 20% reduction in processing capacity due to COVID-19 plant shutdowns could reduce cattle prices by 26% and hog prices by 36%. As they note, these effects may already be “baked in” to future’s prices. Moreover, coming into 2020, animal inventories were high, leading to large projected total meat and egg production for the year. Temporary stocking-up behavior on the part of consumers buoyed demand in the short run following outbreak of COVID-19, providing a respite to the downward price pressure expected for 2020. However, the loss of restaurant sales, coupled with reduced consumer incomes from a likely recession, and export markets for meat products being hard hit by COVID-19 suggest the general downward price movements witnessed in cattle and hog markets may continue even if wholesale prices rebound should processing capacity be adversely affected by disruptions associated with COVID-19.