One of my former Ph.D. students, Mallory Vestal, sought to answer that question in a paper that we just published in the Journal of Agricultural and Applied Economics. Mallory is a horse-lover, a former graduate assistant coach of the Oklahoma State University Equestrian team, and is now an assistant professor at West Texas A&M University. Here's the abstract of the paper:

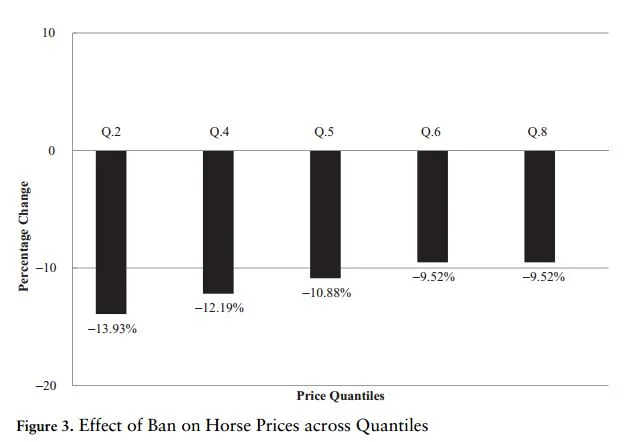

“As a result of several judicial rulings, processing of horses for human consumption came to a halt in 2007. This article determines the change in horse prices resulting from elimination of horse-processing facilities. As expected, lower-valued horses were more affected by the ban than higher-valued horses. The analysis suggests the slaughter ban reduced horse prices, on average, by about 13% and resulted in a loss in producer surplus to sellers of approximately 14% at the sale we analyzed. We also show horse prices are affected by a myriad of factors including breed, gender, age, coat color, and sale catalog description.”

Because "lower value" horses were those most likely to (eventually) head to the slaughter house, we anticipated that their prices would be most affected by the slaughter ban, and that's indeed what we found. Here's the impact of the ban on horses priced in the upper 20$, 40% . . and 80% of the price distribution.

There were a number of interesting side-results, like these . . .

“The indicator variables related to the horse catalog descriptions were significantly

associated with horse prices. Consistent with Levitt and Dubner (2005), an ambiguous description such as “nice” was shown to negatively impact prices by −5% to −10% across all models. A more objective descriptive variable such as “finished” was significant in several of the quantiles examined and in the OLS model. Including the word “finished” in the horse’s description was associated with increased prices from 26% to 68%. This result is intuitive as it indicates the horse has specialized training and will be ready to show in the specified discipline. Another descriptive and informative variable, “100% sound,” positively impacted prices from 8% to 11%, whereas “athletic” and “quiet/gentle” negatively impacted higher-quantile prices by −10% and −8% respectively.”

Want to know my own view on eating horse meat? I hinted at it in this editorial.