A couple years ago I wrote a post about a hypothetical sustainability facts label that is analogous to exiting the nutrition facts panels. In that post, I conjectured that a sustainability facts panel might help alleviate some of the misperceptions some consumers have with regard to various labeling claims. Turns out Sofia Villas-Boas at Berkeley and Zack Neuhofer, a PhD student working with me at Purdue, were simultaneously having similar ideas. As such, we teamed up to test some of these conjectures.

The result is a new paper forthcoming in Applied Economics Perspectives and Policy. Here’s the abstract.

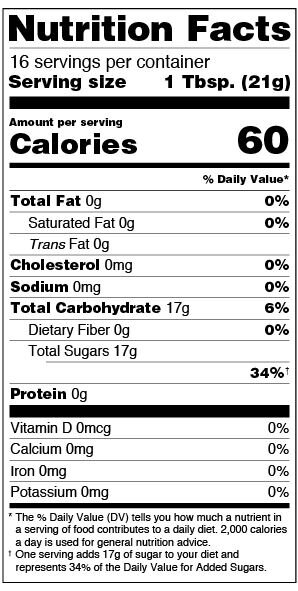

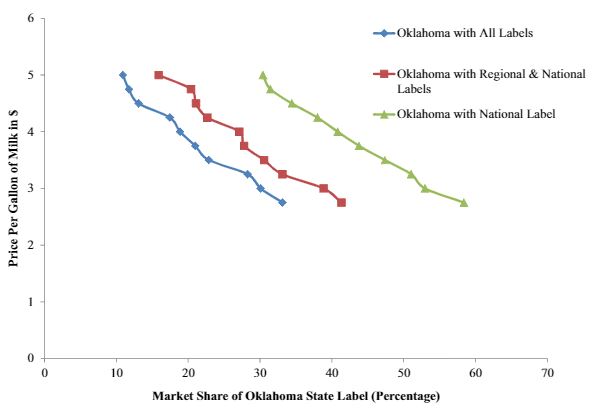

“Consumers often form beliefs about credence attributes unsupported by the best available evidence. In particular, prior research has revealed many consumers have overly-optimistic beliefs about the environmental and nutritional impacts of organic food. We propose and study the effects of a sustainability facts label (SFL), which displays quantitative environmental information related to global warming potential, land use, and energy use per serving size of the product. The SFL is akin to a nutrition facts label (NFL), which we also study. We surveyed a nationally representative sample of milk consumers in the United States (USA) to measure their choices and beliefs about organic vs. conventional milk under one of three different label information treatments; the NFL only, the SFL only, and both labels relative to a control without any nutrition or sustainability information. Unexpectedly, our results show that the SFL increased the likelihood of organic purchases. Facts panels altered beliefs; The participants exposed to the SFL increased their perception that organic performs better on environmental metrics, despite the fact the information contained in the label provided a nuanced picture with organic better in some dimensions and worse in others. Consistent with the information provided, consumers exposed to the NFL decreased their perception that organic had fewer calories and more protein than conventional milk. Prior beliefs about organic were found to be important determinants of choice and information acquisition.”

Kudos to Zack who did the heavy lifting on this project. As it turns out, we didn’t find much support for the original conjecture but instead found a more complex and nuanced set of reactions to “objective” sustainability labels.