“Our result does NOT suggest people will suddenly support GMOs once mandatory labels are in place. ”

Indeed, the data suggest consumers will still want to avoid products with GMO labels, which provides incentives for food retailers and manufacturers to find ways to avoid GMO ingredients.

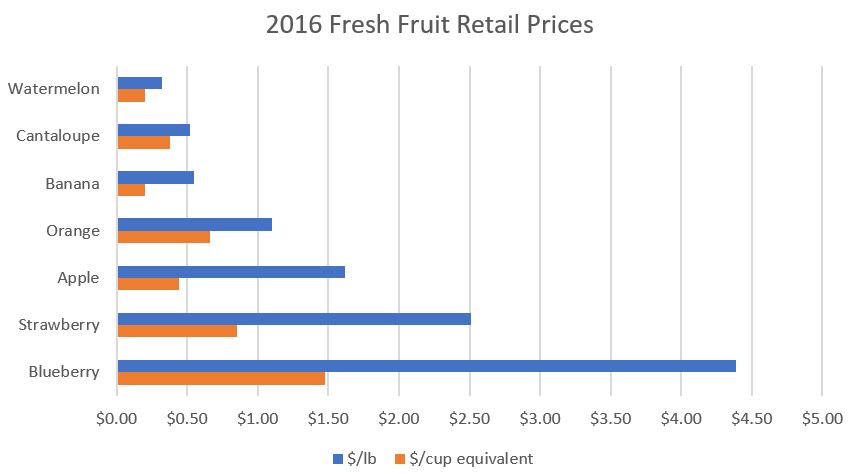

Colin Carter and Aleks Schaefer just published an interesting new study in the American Journal of Agricultural Economics, which powerfully shows that mandatory GMO labels are already having significant market impacts. They found a creative way to explore this issue by focusing on the market for sugar. They provide the following background:

“In the United States, sugar is produced from both sugarcane and sugarbeets. Sugarcane stalks are milled to produce raw sugar. Raw cane sugar is then sent to a refining facility to be transformed into refined sugar. Sugbarbeets, in contrast, have no raw stage; they are processed from beet to refined sugar in one continuous process. The U.S. market share for beet (cane) sugar is approximately 58% (42%). Almost all U.S. sugarbeet production is GE, while cane sugar is GE-free. However, sugar derived from beets is chemically identical to sugar derived from cane.”

This summary data they provide on prices of sugar from cane and beet sources suggests “something” change around the same time as the Vermont mandatory GMO labeling law.

Source: Carter and Schaefer, American Journal of Agricultural Economics

Here are the main findings.

“Our analysis supports the explanation that the divergence in U.S. prices for refined cane and beet sugar was the result of Vermont’s mandatory GE labeling. The divergence occurred on or around July 2016— the month the Vermont Act took effect.

Counterfactual price estimates generated by a regression model suggest that GE food labeling initiatives generated a small premium for cane sugar and a price discount for beet sugar of approximately 13% relative to what prices would have been in the absence of such legislation.”

These changes in raw ingredient prices will ultimately have impacts on retail food prices. All this is suggests that mandatory labels aren’t a free lunch.