In recent months, we’ve experienced some of the highest rates of food price increases since the 1970s. Unless incomes have increased at a comparable rate (which they haven’t), higher food prices imply that consumers’ buying power over food has fallen. That is, consumers cannot afford to buy as much food today as they could in the past. Taken together, all this is reason to keep a close eye on what’s happening to food insecurity.

The official government measure of food insecurity comes out once a year. The most recent release was in October 2022 and corresponded to the year 2021. At that time, the USDA estimated 10.2% of U.S. households were food insecure at some point in 2021. Obviously a lot has happened since then - including a roughly 13% increase in grocery prices.

What is out best current estimate of food insecurity? Is it trending upward?

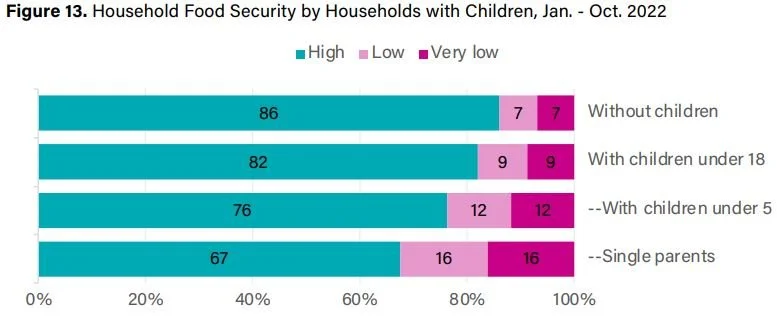

This is a statistic we’ve been tracking in our monthly Consumer Food Insights Survey we put out in the Center for Food Demand Analysis and Sustainability at Purdue. Despite the arguments above, we haven’t yet detected an uptick in food insecurity rates.

But, maybe something is “off” about out sample, survey, or analysis. Fortunately the Census Bureau started an ongoing “pulse survey” in the wake of the COVID19 disruptions, and they include some questions related to food security (they call their measure “food sufficiency”). Moreover, a few other groups have measured food insecurity rates over the past couple years.

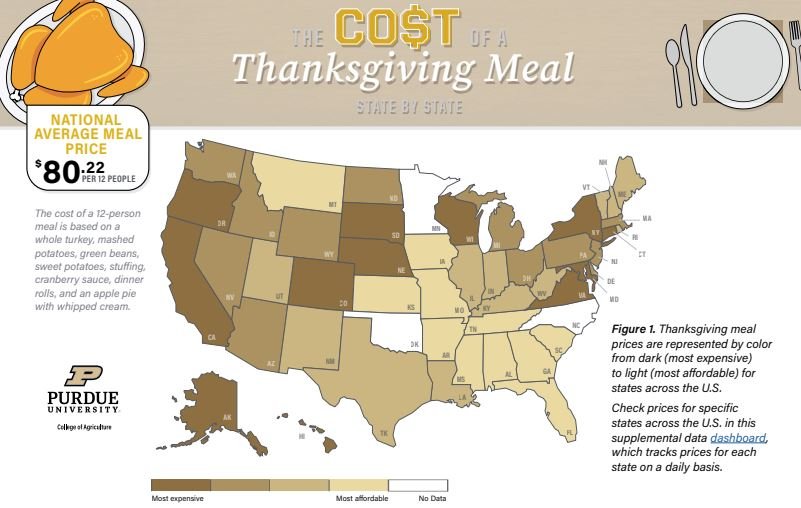

My colleague Sam Polzin has done a masterful job brining together these and a variety of ofther measures of food security from different research groups over the past couple years in the form of a data dashboard that we plan to continue updating.

While there was perhaps an upward trend in food insecurity (or food insufficiency) around the end of last year and the first of this year, food insecurity rates have been fairly flat during most of 2022 (click here if you want to engage with an interactive version of the dashboard).

The result is a bit surprising given the aforementioned increases in food prices and the anecdotal accounts I’ve been hearing from folks working in food banks about being much busier than usual. It is possible that food insecurity hasn’t risen precisely because some of our safety nets have “caught” more vulnerable people and kept them out of food insecurity. For example, SNAP benefits increased in the wake of the pandemic (but are now being scaled back in some states). Still, even in our Consumer Food Insights survey, we are not seeing a trend in the share of people saying they’re getting food from foodbanks.

I’m all ears if someone has a good explanation for the disconnect between the multiple survey-based measures showing stable trends in food insecurity and the reports of longer lines at food banks.