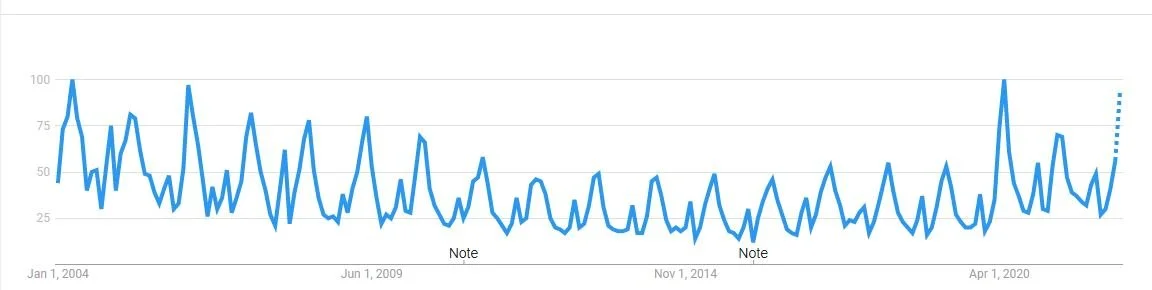

I was chatting with a few colleagues this morning and the topic of gardening came up. Curious as to whether there was more interest in gardening this year as food prices are rising, a search on google trends commenced.

As the graph above reveals, google searches for “gardening” are highly seasonal, peaking in April and May each year. Also interesting is the apparent downward trend in searches for gardening since 2004. The downward trend was disrupted by COVID-19. In 2020, searches for gardening peaked in April and May at levels that hadn’t been seen in at least a decade. In 2022, we appear to be leveling off below the last two years.

While the COVID peak is apparent in the above graph, it wasn’t as large as perhaps might have been expected. In Google Trends, one can also search in categories. If I search “gardening” in the “shopping” category, here’s what I find.

If I understand these data correctly, this is an index of the volume of searches for gardening with the intent to buy gardening-related items. In this rendition, May 2020 is the peak over this 18 year time period. The dotted-line forecast suggests this May may be another banner year for sales of gardening-related wares.

Does gardening respond to economic factors like food prices and recession-induced changes in income or time availability? Is gardening an inferior, normal, or luxury good? Does interest in gardening vary with health concerns? These questions are ripe for academic research.